Google announced Media CDN, a platform for distributing content using the same infrastructure that powers YouTube, in wide availability this week at the 2022 NAB Show Streaming Summit. Google says its Media CDN is aimed to “automate all elements” of “providing content [near to consumers]” and has a presence in over 1,300 locations across 200 countries.

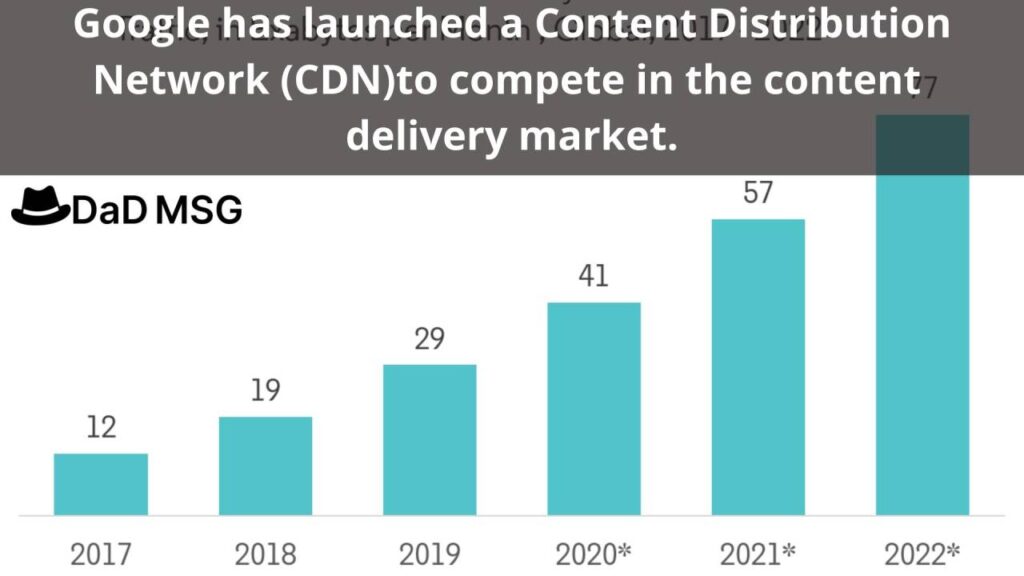

As a result of company closures and shelter-in-place orders, there was an upsurge in demand for streaming entertainment during the epidemic. Streaming video accounted for 53.7 per cent of internet bandwidth usage, up 4.8 per cent from a year earlier, according to The Global Internet Phenomena Report. Companies that offer access to content delivery networks (CDNs), which are collections of servers meant to accelerate the transmission of web material, reaped huge rewards. According to one projection, CDN income would increase by 7% to $4.45 billion in 2020.

By no means is Media CDN, which now joins Google’s CDN portfolio for web and API acceleration, the first of its sort. Several CDNs specialise in serving media. However, Google promotes unique features such as customised delivery techniques for specific users and network circumstances, as well as “industry-leading” offload rates.

Google VP Shailesh Shukla stated in a blog post yesterday, “With many stages of caching, we limit calls to origin – even for seldom accessed material.” “This reduces content origin performance or capacity stress and saves money.”

Customers may dynamically inject video content with adverts using the Media CDN’s ad insertion technologies. Furthermore, Google claims that the service is “designed with AI/ML” to enable interactive experiences such as real-time analytics during sporting events and buy buttons embedded in virtual billboards.

“Media CDN provides robust APIs and automation tools… Shukla stated, “Detailed, pre-aggregated data and playback tracing make it straightforward to diagnose performance throughout the whole infrastructure stack.” “Google Cloud’s operations suite provides real-time visibility.”

When it comes to CDN services, Google is a little fish in a large pond. According to IDC, Akamai owned 42 per cent of the CDN market in 2019. ChinaNet Center came in second with 13% of the market that year, followed by Verizon with 5%.

However, according to Eric Schmitt, a senior research director at Gartner, the Media CDN paves the way for Google to further increase its dominance in streaming video and web advertising.

Schmitt told TechCrunch via email that “Media CDN signifies a further growth of the [Google parent company] Alphabet empire, in this case by commercialising the pipes that YouTube utilises to serve streaming video.” “TV and video content producers that use Google’s Media CDN technology may anticipate top-of-the-line scalability. On the other hand, as Google builds out linkages between its cloud offerings and its advertising software products, prospective customers must weigh the risks of becoming technically dependent on Google for advertising delivery, and eventually perhaps even commercially dependent on Google for ad sales and measurement.”

If that forecast proves to be correct, Media CDN might help support a cloud sector that has failed to make money so far. Alphabet recently said that Google Cloud — the business arm that includes Media CDN — expanded 43 per cent in Q1 2022 to $5.8 billion, but that its operational losses widened to $931 million.